GSG Blog

Welcome to the GSG blog, where decades of financial expertise meet innovation. Explore thought leadership, expert insights, and practical advice to navigate today’s complex financial landscape and help your business thrive.

Featured Post

Get GSG’s Help with Beneficial Ownership Information Reporting

Please fill out this form as soon as possible if you are a client of Gorfine, Schiller & Gardyn and would like assistance in completing your Beneficial Ownership Information reporting requirement. Click here for more resources [...]

Newsletter Sign Up

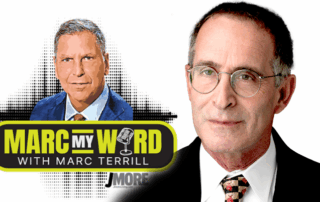

Aaron Bloom Discusses Value of Volunteering on Marc My Word Podcast

Director Aaron Bloom joins the Marc My Word Pod to discuss volunteerism

IRS clarifies theft and fraud loss deductions

Victims of scams may be able to claim theft or loss deductions

Breaking Misconceptions Around Financial Audits

Jenny Estrada joins us on the line to discuss misconceptions around being an auditor.

Mitigate the risks: Tips for dealing with tariff-driven turbulence

The tariff landscape is rapidly evolving. Explore the essentials of a tariff strategy and influences on trade dynamics in today's economy.

Beneficial ownership reporting requirements suspended

The twisty journey of the Corporate Transparency Act’s (CTA’s) beneficial ownership information (BOI) reporting requirements has taken yet another turn. Following a February 18, [...]

PODCAST | Family and Medical Leave Program

Understanding medical leave is essential for employees. Learn your rights and options regarding medical leave today.